Didi shares are due to start trading on Wednesday on the New York Stock Exchange under the symbol DIDI Goldman Sachs Morgan Stanley and JP. At the upper end of its indicated price range the company expects to raise more than 4 billion in its IPO which could be one of the largest this year.

The company plans to list its stock as American Depositary Share and there will be a total of 288 million of them in the IPO.

Didi stock ipo. The filing documents show that the company earned 216 billion in revenue for 2020. Morgan are the lead underwriters for the IPO. Chinese ride hailing company Didi Global Inc raised 44 billion in its US IPO on Tuesday pricing it at the top of its indicated range and increasing the number of.

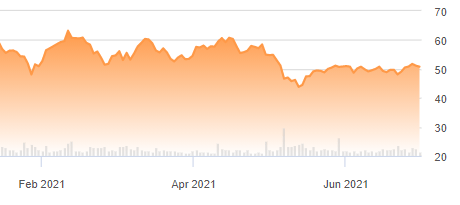

The company jumped as much as. Investors should steer clear of Chinese riding hailing company Didi following its IPO a veteran stock analyst said. Shares of Didi Chuxing closed up a modest 1 Wednesday afternoon after spiking as much as 286 in the Chinese ride-hailing giants market debut.

Chinese ride-hailing giant DiDi Global NYSEDIDI saw its stock shoot up nearly 30 following a hotly anticipated IPO that valued the firm at more than 67 billion. It was the largest IPO on a day when at least 10 companies. Didis IPO is more conservative versus its initial aim for a valuation of up to 100bn Reuters has previously.

Didis IPO is more conservative compared with its initial aim for a valuation of up to 100 billion. The DiDi IPO has been a subject of speculation for some time. Each of these ADSs would be priced between 13 and 14 per share.

On Wednesday June 30 Didi will begin trading on the NYSE under the stock ticker symbol DIDI of course. Accordingly Didi is set. Didi raised 44 billion by selling 3168 million shares more than the 288 million American depositary shares it had planned to offer.

Didi is expected to trade tomorrow on the New York Stock Exchange under the ticker DIDI. The size of the deal was cut during briefings with investors ahead of the IPOs launch. The company is expected to debut on the New York Stock Exchange on June 30.

Didi Global Prices IPO at 14 a Share Chinese ride-hailing company sells more stock than planned giving it a market capitalization of at least 67 billion Didis booth at the World Intelligence. 30 2021 0124 PM. The Beijing-based transportation app which dominates ride-hailing in its home country is set to make its debut as a US-listed public company on Wednesday.

Didis IPO will not make investors any money and the business is just as unprofitable as Uber and Lyft a veteran stock analyst says Emily Graffeo Jun. This was nearly a 10 percent drop in revenue. According to Barrons its IPO is expected to potentially be one of the biggest of the.

Didi is looking to potentially raise more than 4 billion as a result of this IPO.

Didi Chuxing Ipo Ride Hailing Firm Aims For A 67 Billion Valuation Fortune

:max_bytes(150000):strip_icc()/logo1457424070-5bfc47b3c9e77c0051a108f7.png)

Didi Global Didi Ipo What You Need To Know

Jatuh Bangun Didi Ride Hailing Raksasa Asal China Yang Akan Ipo Di Bursa As

/unnamed-984fee51fa4743d09e0a123ec903a3b1.jpg)